Financial planner with federal certificate: overview of schools, tests, success stories, tips

Are you interested in working as a financial planner with a federal certificate? With the appropriate training, you can acquire knowledge in the analysis and planning of financial flows and assets - including risk management for private clients. Here you will find suitable schools as well as further information, tips and resources for further training.

Would you like personal advice on financial planner training? Contact the provider of your choice via the "Free information on the topic..." button or download the free course documents - without obligation, quickly and easily.

Financial planner with a federal certificate: Professionals in wealth planning, pensions and real estate

As qualified specialists in the financial services sector, financial planners advise and support private individuals with low to medium incomes and assets in the areas of wealth planning, pensions, insurance, financing and real estate. They create customized concepts for their clients, such as a retirement financing plan. To do this, they clarify the client's needs, analyze income and expenditure as well as assets, debts and taxes. They support their clients in financially managing life events and providing financial security in all phases of life.

Training and degree:The training to become a financial planner with a federal certificate builds on the IAF diploma in financial consulting and leads to a federal certificate, which is also recognized by the Swiss Financial Market Supervisory Authority (FINMA) and accredited by CICERO, the learning accreditation system of the Swiss insurance industry. The course has been in existence since 1999 and is well established on the Swiss job market.

Relevance:Many events in life - marriage, children, house purchase, divorce, legal disputes, early retirement, inheritance, etc. - present not only psychological and physical challenges, but also financial ones. In these cases, a financial plan is often very helpful. The best way to draw one up is with competent financial experts who have in-depth knowledge of the usual market investment, credit, pension and insurance instruments and are familiar with current financial trends and risks. Financial planners with a federal certificate are the right people for this and are in high demand in the financial world.

Activity and learning content:Financial planners with a federal certificate are employed in financial services companies such as banks, insurance companies, fiduciary or tax consulting firms of all sizes and are usually in middle management. The training provides in-depth knowledge of financial planning in general (pension provision, investments) and specific financial planning for private households (development planning, pension planning, taxes, real estate).

Personal requirement:The financial planner training for the federal certificate is aimed at communicative, trustworthy and customer-oriented professionals in financial institutions. If they have good perimeter skills and strong conceptual and analytical abilities and would like to provide financial advice to people in various life situations and develop prospects with them, this further training course is the right choice for them.

Questions and answers

Tips, tests and information on "Financial planner with federal certificate"

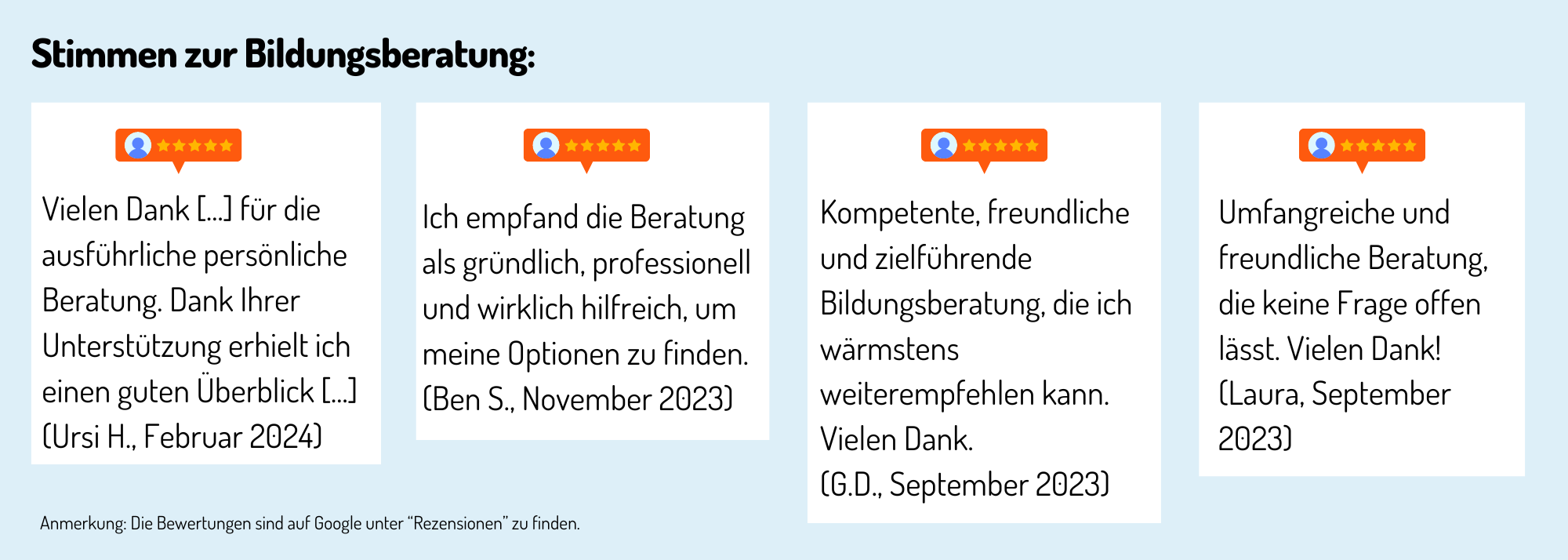

Erfahrungen, Bewertungen und Meinungen zur Ausbildung / Weiterbildung

Haven't found the right training or further education yet? Benefit from educational advice now!

Further training is not only important in order to maintain or increase professional attractiveness, investing in training or further training is still the most efficient way to increase the chances of a pay rise.

The Swiss education system offers a wide range of individual training and further education opportunities - depending on your personal level of education, professional experience and educational goals.

Choosing the right educational offer is not easy for many prospective students.

Which training and further education is the right one for my path?

Our education advisory team will guide you through the "education jungle", providing specific input and relevant background information to help you choose the right offer.

Your advantages:

You will receive

- Suggestions for suitable courses, seminars or training programs based on the information you provide in the questionnaire

- An overview of the different levels and types of education

- Information about the Swiss education system

We offer our educational counseling in the following languages on request: French, Italian, English

Register now and concretize your training plans.