Customer advisor bank: training, schools and offers at a glance

Prepare for the examinations to become a customer advisor bank with an internationally recognized certificate in a preparatory course.

Here you will find suitable schools as well as further information, tips and resources for further training.

Would you like personal advice? Contact the provider of your choice via the "Free information on the topic..." button - without obligation, quickly and easily.

Customer Advisor Bank: Get your skills and knowledge certified.

Are you a customer advisor in a bank and would like to be certified in this segment? Then you have the option of a state-accredited certificate, which is based on the international standard ISO/IEC 17024 and will earn you one of the following designations once you have obtained it:

- Certified individual client advisor

- Certified Private Client Advisor / Certified Private Client Advisor

- Certified Corporate Banker CCoB

- Certified Wealth Management Advisor CWMA

Thanks to one of these titles, which is valid for a period of three years and must then be renewed with a recertification, you will stand out from your competitors and colleagues, increase your customers' trust in you as an advisory specialist and gain in-depth expertise in conducting customer meetings. With a course that prepares you for the "Customer Advisor Bank" certification exam, you will acquire all the knowledge you need through self-study with e-learning and then take a specialist banking exam.

You can prepare for the oral exam at the schools in a sales training course, including product training, which is not compulsory but is recommended for less experienced advisors in particular. After taking the oral exam, which requires you to pass the written exam, you will receive the coveted certificate, which certifies your knowledge of advisory processes, individual client solutions and financial products.

You can choose between different types of study, between a self-study course with around 50 hours of study (private clients) and a more extensive course with around 130 hours of study (individual clients). These two options are suitable for anyone who works in a financial institution, has client contact as an advisor in the areas of asset management, investment or finance or is involved in managing a client book. In the "Client Advisor Bank / Client Advisor Bank Individual Clients" course, you will acquire comprehensive knowledge on the following topics:

- Strategy private clients

- Precaution

- Pay and save

- Financing

- Attachments

- Legal, Risk and Compliance

The personal certification course for private clients does not include the area of financing, as well as some key topics within the main topics, such as content on the 1st and 2nd pillar, accident insurance and matrimonial and inheritance law.

Are you interested in this certificate and would like more information about the schools that offer preparation courses, as well as the exact dates, locations and content? Then simply use our contact form to have the relevant schools, which you can find at the top of this page, send you all the necessary documents by e-mail.

Questions and answers

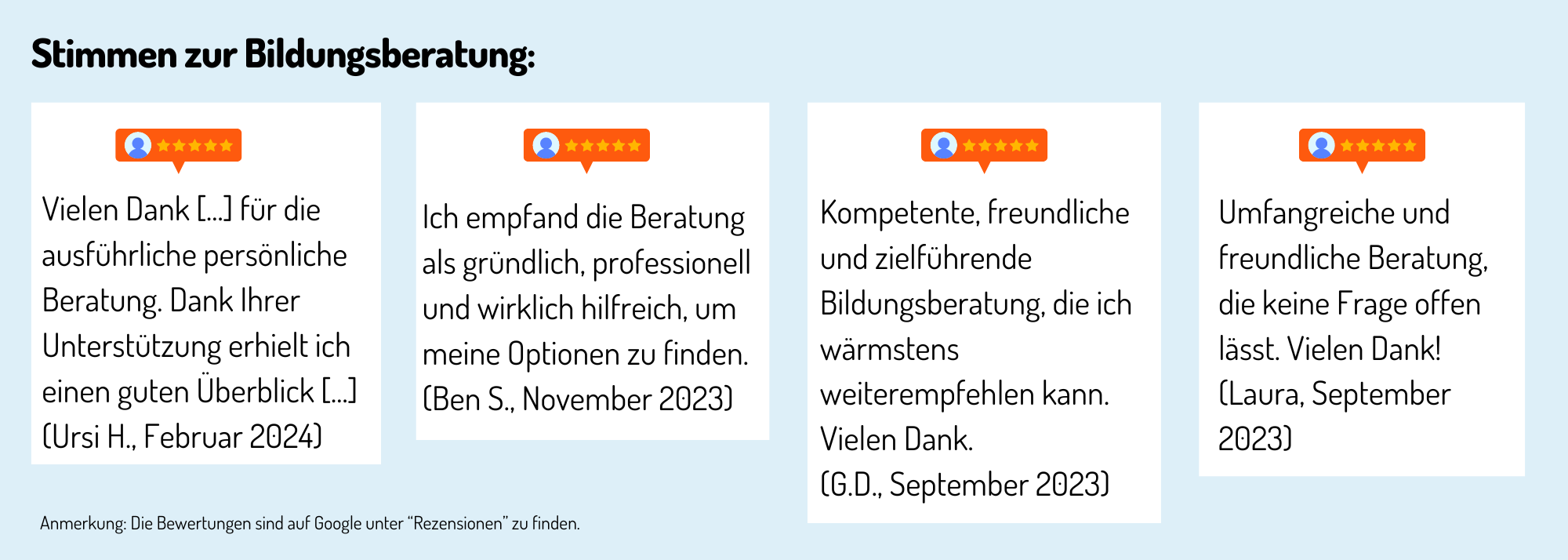

Erfahrungen, Bewertungen und Meinungen zur Ausbildung / Weiterbildung

Haven't found the right training or further education yet? Benefit from educational advice now!

Further training is not only important in order to maintain or increase professional attractiveness, investing in training or further training is still the most efficient way to increase the chances of a pay rise.

The Swiss education system offers a wide range of individual training and further education opportunities - depending on your personal level of education, professional experience and educational goals.

Choosing the right educational offer is not easy for many prospective students.

Which training and further education is the right one for my path?

Our education advisory team will guide you through the "education jungle", providing specific input and relevant background information to help you choose the right offer.

Your advantages:

You will receive

- Suggestions for suitable courses, seminars or training programs based on the information you provide in the questionnaire

- An overview of the different levels and types of education

- Information about the Swiss education system

We offer our educational counseling in the following languages on request: French, Italian, English

Register now and concretize your training plans.