Insurance specialist with a federal certificate: training, further education, providers, self-test

Are you looking for an insurance specialist training course? - Here you will find suitable schools as well as further information, tips and resources for further training.

Would you like to receive personal advice on insurance specialist training? Contact the provider of your choice via the "Free information on the topic..." button - without obligation, quickly and easily.

Read our information, tips and tests to find out more about the level of awareness, requirements, costs, salary, duration, etc. of further training and professional examinations for insurance specialists.

Self-test "Insurance specialist with federal certificate": Is this course the right one for me?

Tipps und Entscheidungshilfen für die Ausbildungswahl

The insurance specialist develops long-term insurance planning for private individuals, SMEs and the self-employed based on individual concerns. Depending on the task and company, you will take on different processing and decision-making competencies. They work in the areas of life, accident, social and health insurance, transport insurance and technical insurance, as well as in the liability, property and asset insurance sectors and have comprehensive insurance expertise.

The insurance specialist with a federal certificate is responsible for organizing and protecting policyholders against the financial consequences of personal or material dangers or risks in the event of accidents and/or claims. They often act as advisors in customer service. You have an overview of the possible effects of claims. You also understand the internal and external contexts of your chosen insurance sector.

You can specialize in the area of personal insurance or property and asset insurance, with a particular focus on practical application. You will use your specialist knowledge in a targeted manner in risk analysis and in planning for optimum insurance cover. The review of a claim usually takes place on site, where you deal with the given facts. You are therefore constantly faced with new challenges, as negotiations must be conducted to the satisfaction of all parties involved. A claim is often preceded by clarifications with experts from other sectors.

The insurance specialist from the claims department checks the coverage and liability issues for incoming claims notifications after the various facts have been compiled. Depending on the function and company, you have different processing and decision-making powers. In the sales force, on the other hand, you sell insurance benefits. In order to conduct negotiations successfully, you need to master the most important basic rules of service marketing and sales. You must be familiar with information on rates, special conditions, the conclusion of contracts and the most important principles of insurance law, and you must always be informed about the latest offers in the industry.

You will find a wide range of jobs in middle management in the following areas: in the benefits/claims area, in the field service, in sales or consulting at agencies or at the insurance company's head office, in public administration, at various associations and organizations. However, you can also specialize in one area within the banking or insurance sector.

Are you interested in further training in this area? Then find out about the specific options here on the large Swiss education portal Ausbildung-Weiterbildung.ch.

Questions and answers

Tips, tests and information on "Insurance specialist with federal certificate (BP)"

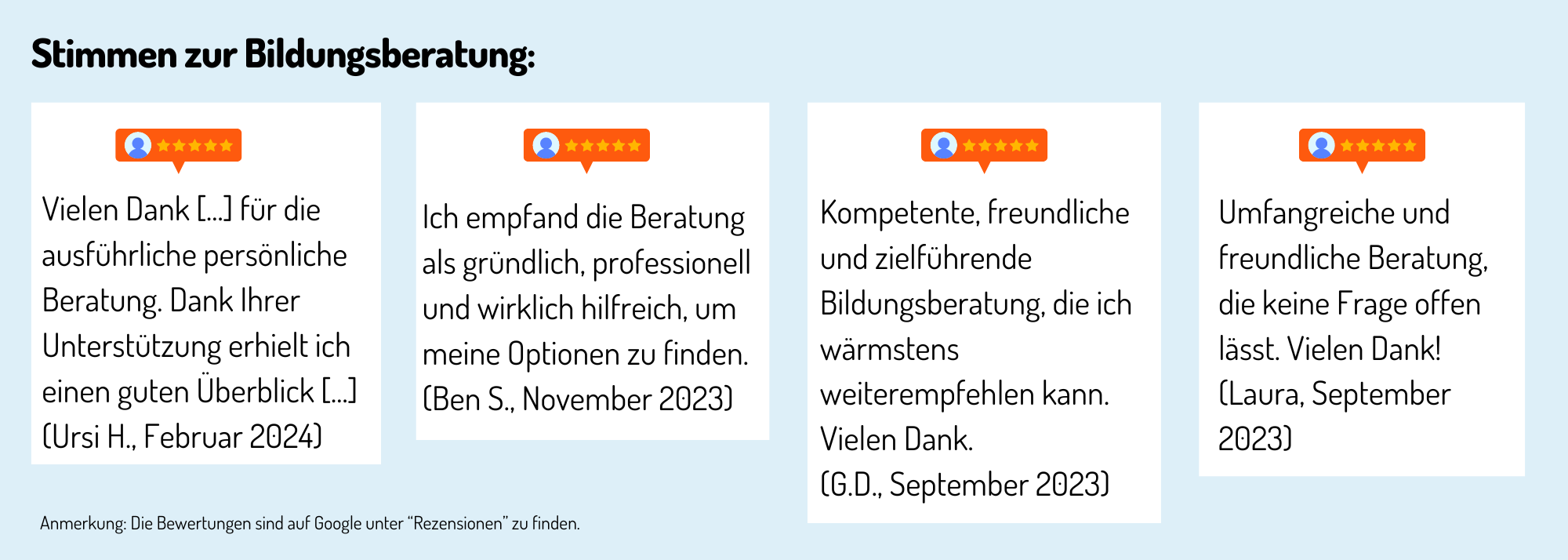

Erfahrungen, Bewertungen und Meinungen zur Ausbildung / Weiterbildung

Haven't found the right training or further education yet? Benefit from educational advice now!

Further training is not only important in order to maintain or increase professional attractiveness, investing in training or further training is still the most efficient way to increase the chances of a pay rise.

The Swiss education system offers a wide range of individual training and further education opportunities - depending on your personal level of education, professional experience and educational goals.

Choosing the right educational offer is not easy for many prospective students.

Which training and further education is the right one for my path?

Our education advisory team will guide you through the "education jungle", providing specific input and relevant background information to help you choose the right offer.

Your advantages:

You will receive

- Suggestions for suitable courses, seminars or training programs based on the information you provide in the questionnaire

- An overview of the different levels and types of education

- Information about the Swiss education system

We offer our educational counseling in the following languages on request: French, Italian, English

Register now and concretize your training plans.