Wirtschaftsprüfer: Training providers, information, questions & answers

To work in auditing, you need a sound knowledge of business informatics so that you can assess accounting and reporting systems. Are you looking for a suitable school for training or further education to become an auditor (HFP)? This enables you to take on a position of responsibility for monitoring accounting and its compliance with the applicable accounting and legal standards.

Certified public accountant with a federal diploma

In today's complex economic environment, entrepreneurs must provide reliable and comparable statements.

An auditor is responsible for the management of the company and for analyzing its internal and external weaknesses and strengths. He ensures correct accounting and compliance with legal requirements within the company. They are also familiar with the relevant national and international accounting regulations and are able to interpret them in a meaningful way. An auditor uses the appropriate tools for this purpose: internal and external analyses, process audits to assess the company's internal controls, spot checks, tests, inspections, obtaining external confirmations, plausibility considerations and discretionary decisions based on documents and interviews. As an independent auditing body, it confirms the accuracy of the financial statements in accordance with legal requirements and/or the guidelines applied.

Business partners, e.g. banks, shareholders, suppliers, customers and other employees, as well as the public, rely on accurate accounting information. Statutory requirements, such as the audit of the annual financial statements, the audit of formation, capital increase, capital reduction and special statutory audits in accordance with the Banking Act are fulfilled by external auditors. Every auditor can also provide external advice on insurance and tax issues or internal audits in larger companies, groups and in administration - he is a sought-after executive. They are also experts in financial and operational accounting, business management and organization, commercial law and company valuations for potential takeovers or restructurings.

Once an auditor has audited the actions, he or she prepares reports that are delivered to the client, e.g. the company management or the authorities, in accordance with the law, the order and the level. Would you be interested in further training in this responsible area? Then find out about the various options on the large education portal Ausbildung-Weiterbildung.ch. You can also request detailed documents directly from the individual providers.

Questions and answers

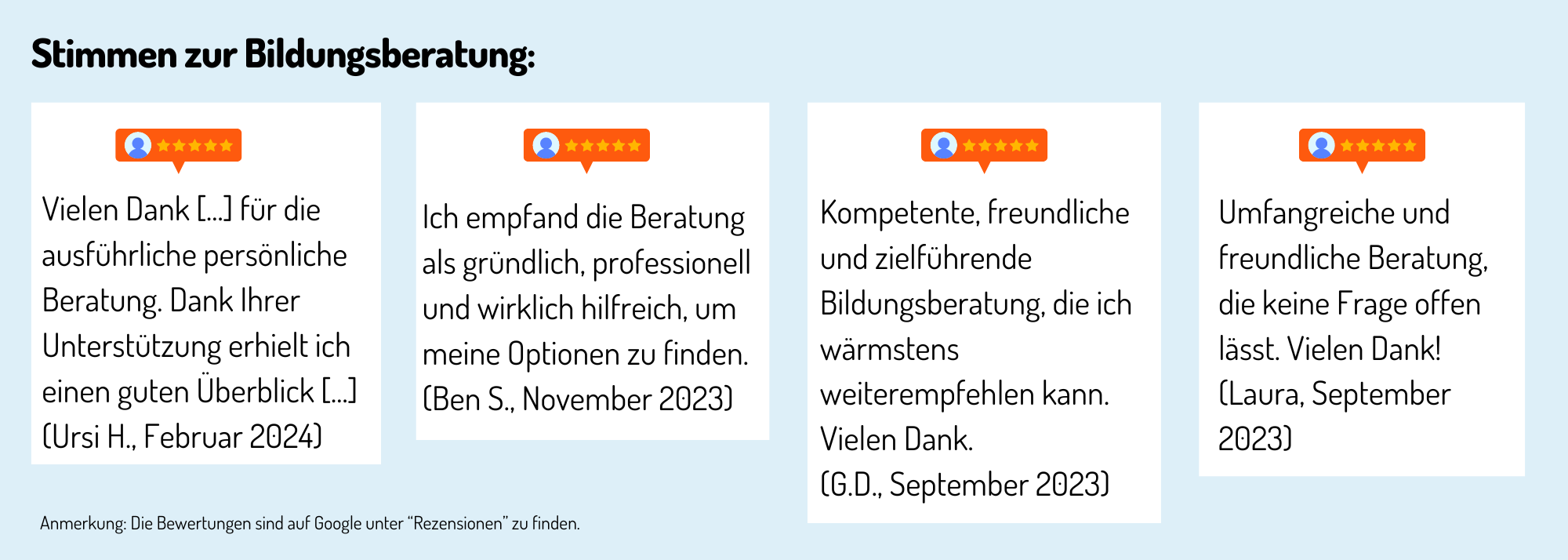

Erfahrungen, Bewertungen und Meinungen zur Ausbildung / Weiterbildung

Haven't found the right training or further education yet? Benefit from educational advice now!

Further training is not only important in order to maintain or increase professional attractiveness, investing in training or further training is still the most efficient way to increase the chances of a pay rise.

The Swiss education system offers a wide range of individual training and further education opportunities - depending on your personal level of education, professional experience and educational goals.

Choosing the right educational offer is not easy for many prospective students.

Which training and further education is the right one for my path?

Our education advisory team will guide you through the "education jungle", providing specific input and relevant background information to help you choose the right offer.

Your advantages:

You will receive

- Suggestions for suitable courses, seminars or training programs based on the information you provide in the questionnaire

- An overview of the different levels and types of education

- Information about the Swiss education system

We offer our educational counseling in the following languages on request: French, Italian, English

Register now and concretize your training plans.