MLA: Training, further education, providers, information

Are you looking for training to become a Thena GwG? - Here you will find suitable schools as well as further information, tips and resources for further training.

Would you like personal advice on the MLA offer? Contact the provider of your choice via the "Free information on the topic..." button - it's quick, easy and non-binding.

Tipps und Entscheidungshilfen für die Ausbildungswahl

Money laundering has been enshrined in the Swiss Criminal Code since 1990 and has therefore been actively combated in Switzerland since the early 1990s. Art. 305bis criminalizes money laundering, while Art. 305ter regulates the reporting rights of members of the financial sector and sanctions insufficient due diligence in financial transactions.

The Federal Act on Combating Money Laundering in the Financial Sector (AMLA) was enacted on October 10, 1997 and is the responsibility of banks, investment companies (e.g. investment companies), venture capital funds and insurance companies (financial intermediaries) on the one hand and the para-banking sector such as independent trustees, money changers and transmitters and asset managers on the other.

The Swiss Financial Market Supervisory Authority FINMA is responsible for the supervision of financial intermediaries with regard to compliance with the AMLA.

Financial intermediaries and the para-banking sector are under enormous pressure in Switzerland and abroad in terms of legal and image risks. They are therefore dependent on experienced employees and specialists in the area of AMLA who are familiar with the current regulations. Appropriate training courses are essential for compliance officers at banks, insurance companies, employees of the central register or auditing organizations.

The education portal Ausbildung-Weiterbildung.ch is recommended for a suitable overview of possible and recommendable education courses in the area of AMLA. It gives you a good overview of the current training courses available and puts you in direct contact with the individual training providers. You also benefit from additional services on the portal which will be of great benefit to you when choosing and planning your further education.

Questions and answers

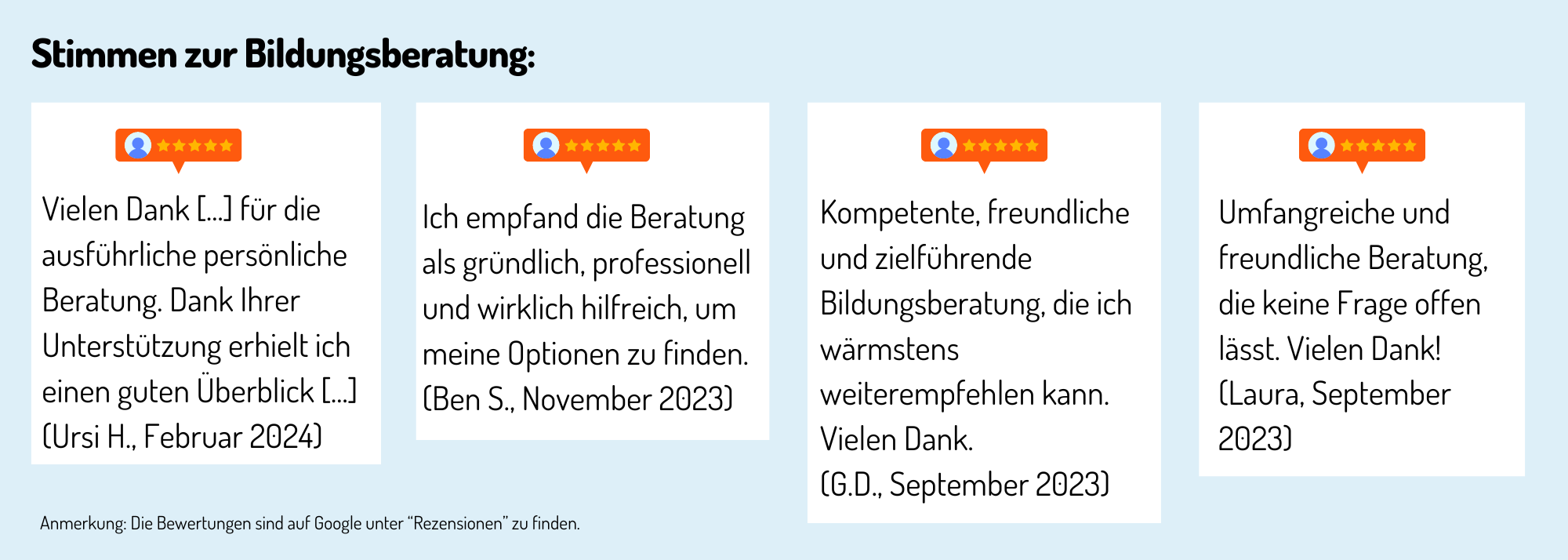

Erfahrungen, Bewertungen und Meinungen zur Ausbildung / Weiterbildung

Haven't found the right training or further education yet? Benefit from educational advice now!

Further training is not only important in order to maintain or increase professional attractiveness, investing in training or further training is still the most efficient way to increase the chances of a pay rise.

The Swiss education system offers a wide range of individual training and further education opportunities - depending on your personal level of education, professional experience and educational goals.

Choosing the right educational offer is not easy for many prospective students.

Which training and further education is the right one for my path?

Our education advisory team will guide you through the "education jungle", providing specific input and relevant background information to help you choose the right offer.

Your advantages:

You will receive

- Suggestions for suitable courses, seminars or training programs based on the information you provide in the questionnaire

- An overview of the different levels and types of education

- Information about the Swiss education system

We offer our educational counseling in the following languages on request: French, Italian, English

Register now and concretize your training plans.